United Kingdom

Navigating HMRC’s new Advance Tax Certainty service

A strategic tool for major investors?

4 February 2026

First announced at Spring Statement 2025, HMRC’s new Advance Tax Certainty for Major Projects service will be operational from July 2026. The regime signals an important recognition that tax certainty is critical to supporting confident investment decisions within the UK. Draft legislation was published in December 2025 in the current Finance Bill before Parliament, with draft guidance published shortly thereafter.

This article provides an overview of the new clearance service, highlighting its key features, the application process, certain limitations, and ongoing taxpayer responsibilities.

Key features of the service

The regime aims to be a more collaborative and transparent process than currently exists for non-statutory clearance applications, requiring active engagement from applicants, their advisors, and HMRC. It is specifically tailored for major investment projects, offering HMRC’s view on complex tax issues upfront, potentially covering Corporation Tax, VAT, Stamp Duty Land Tax, Income Tax, PAYE Regulations, and the Construction Industry Scheme. Where clearance is granted, it will be valid for a period of five years, potentially subject to five-year renewals with agreement from HMRC.

Scope and eligibility

Who Can Apply: A “qualifying person” may apply for a clearance. This can be the entity incurring the project expenditure or a person who controls it (ensuring the regime is available for investment by a company not yet in existence). Draft guidance clarifies that the service can also apply to joint venture entities with no single controlling party, where one applicant can apply on behalf of others. Both UK and non-UK resident entities investing in the UK are eligible.

Financial Threshold: Initially applicants will need to demonstrate at least £1 billion of UK qualifying expenditure over the lifetime of the project, which should be reflected in a corporate business plan or authorised project spend. For very large, staged projects, the projected cost of subsequent phases can be considered. The intention is to review the service and a future reduction in the qualifying threshold may be considered.

Qualifying Project Expenditure: Draft legislation defines “UK expenditure” for the purposes of the financial threshold and encompasses expenditure on goods, intangible assets, and services (excluding financing) used or consumed in the UK or the UK continental shelf, as well as immovable property in these areas. Interestingly, tangible fixed assets are not specifically included in the wording of the legislation although the draft guidance states that project expenditure incudes the acquisition of tangible assets, like plant and machinery. It is therefore understood that infrastructure and other large investments into tangible fixed assets should qualify for the regime.

Exclusions from Applying: Draft guidance sets out a non-exhaustive list of exclusions from eligibility, typically relating to previous incidences of tax non-compliance. The list includes receiving a deliberate penalty under Schedule 24 Finance Act 2007, or Schedule 25 Finance Act 2003; admitting to deliberate underpayment of tax under Code of Practice 8 or 9 proceedings; reaching agreement with a prosecutor under a Deferred Prosecution arrangement, and incurring a defeat in respect of DOTAS or DASVOIT. It is assumed that these exclusions apply where the applicant itself has a history of non-compliance, rather than if other entities in the same corporate group have incurred the relevant penalties. However, since the exclusions from eligibility are mentioned only in the guidance this is not without doubt.

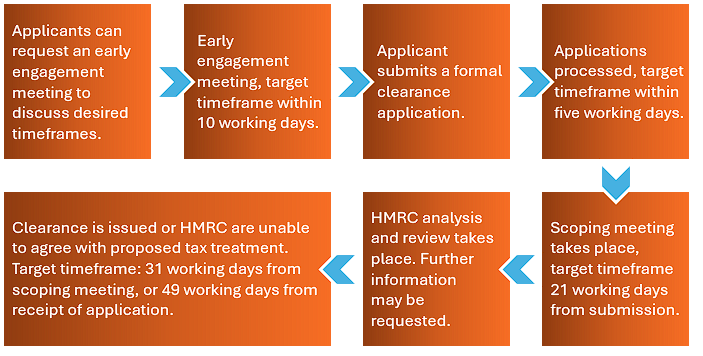

Process and clearance

The process is designed to be structured and collaborative, involving separate phases depending on the complexity and areas of tax uncertainty. The service aims for a 90-day turnaround from formal submission to issuing a clearance, subject to the complexity of the case and agreement with the applicant. Typical steps in the clearance process are expected to be as outlined below:

A clearances approval board, comprising independent representatives from various HMRC departments covering policy, operations, legal and subject matter experts, will be responsible for reviewing recommendations on all clearance applications. This is to ensure decisions are consistent and conform with HMRC’s policy positions. Where a clearance is granted, it will be unilaterally binding on HMRC, allowing an applicant to take a contrary position in its tax return if it chooses to do so, although noting that an enquiry into the tax return is likely to follow if the applicant takes this approach.

Limitations of the regime

While the advance tax certainty service could offer certain benefits it is crucial for investors to understand key limitations and the circumstances under which a clearance may be revoked.

A critical omission in current guidance concerns the precise level of certainty HMRC will require to grant a clearance application. This ambiguity raises fundamental questions about the service's practical utility. Will HMRC only issue clearances for positions deemed 'virtually certain' to be correct? Or will they accept conclusions with a 'should' level of certainty (high probability) or even 'more likely than not' (greater than 50%)? A stringent 'virtually certain' threshold risks limiting the service's value, as it would primarily benefit positions already reasonably clear, offering little to taxpayers facing genuine ambiguity. Conversely, accepting lower certainty thresholds would significantly enhance the service's utility, providing crucial comfort for complex or debatable transactions. Without explicit clarification on these certainty thresholds, taxpayers face a dilemma, undermining the very 'certainty' the service is intended to provide and highlighting an urgent need for further guidance to build confidence in the regime.

Period of validity: The investment size required to qualify for the regime is likely to apply to projects with a lifetime exceeding the five-year period of validity (subject to five-year renewals with agreement from HMRC). Where certainty of tax treatment is critical to the investment decision, a five-year clearance may not offer the longevity required to encourage investment.

Change in law: A clearance will not protect against changes in law, including new binding case law. If such changes materially alter the tax treatment agreed upon that aspect of the clearance would cease to apply. This limitation could diminish the benefit of a clearance. For example, if a clearance determines the stage at which a project will commence a trade for tax purposes, and this certainty is critical to the decision to invest, a change in law before the project reaches that stage would presumably render the clearance null and void. HMRC have verbally stated that they do not anticipate changes in case law being applied retrospectively to clearances, however it is unclear how this will apply in practice. HMRC have also indicated they would be unlikely to pursue a tax case in court where a clearance had already been given on the same facts, but there does not appear to be anything in the clearance process to protect from that happening.

Modification and revocation: A clearance may be wholly or partially revoked, or modified if there is a material change in the facts upon which it was based. This includes where information provided to HMRC is found to be false or misleading, or if critical assumptions are no longer met due to project changes. Given the likelihood of changes to projects of this magnitude, the potential revocation of clearances could represent a significant reduction in the value of the clearance and the certainty that it is intended to give. Detailed guidance and agreement in the clearance itself on what changes require disclosure is critical if applicants are to have confidence in the regime.

Where HMRC will not offer clearance: Clearances will not be granted on matters outside of HMRC functions, draft legislation not yet passed by Parliament, asset valuation, and transactions considered speculative or not under serious consideration. Clearances will also not be given where existing statutory clearance mechanisms exist, or on the application of anti-avoidance legislation. However, draft guidance suggests HMRC may offer an indication that there is a low risk of future compliance intervention regarding the unallowable purpose rules as applied for loan relationship and derivative contracts purposes. HMRC will generally not offer a clearance on matters of fact but will consider such matters on a case-by-case basis. The latter exclusion is surprising, given that when the regime was announced in Spring Statement 2025, one of the stated advantages of the regime was that it would not require demonstration of genuine uncertainty. This led some to believe the regime would apply to both legal and factual uncertainties, rather than solely legal ones. If there is genuinely no uncertainty regarding tax treatment it is unclear what applicants would gain from going through the clearance process. If clearances cannot be given on how the tax rules will apply to a project’s specific facts and circumstances – for example, the stage at which a specific project will commence a trade for tax purposes – this limitation is likely to deter applications. Without the ability to gain certainty on the factual application of tax rules, the practical benefit of the clearance process for many complex projects is significantly diminished.

The regime is limited to qualifying investment projects and there is little detail on the meaning of a project for these purposes (other than the required £1 billion threshold of investment), for example, whether it could cover the creation of head office functions in the UK without significant tangible presence.

Penalties and compliance responsibilities

Penalties ranging between £5,000 and £10,000 apply for certain failures, including failure to notify material changes; failure to comply with a request for information, or carelessly or deliberately making a false or misleading statement to an HMRC officer. HMRC may also revoke the clearance, treating it as if it had never been given.

The granting of a clearance does not end the taxpayer's obligations; rather, it initiates a period of ongoing responsibility, including monitoring compliance with the clearance and undertaking an annual review of conditions, demonstrating how the criteria continue to be met. For projects extending beyond the initial five-year validity period, a renewal request must be submitted to HMRC at least six months before expiry. This process will focus on confirming updates to the project, reassessing key facts and assumptions, and checking against current exclusion criteria and the legal framework.

Conclusion

The advance tax certainty service offers an opportunity to increase investor confidence by providing clarity and predictability in the UK tax regime. While the draft guidance and legislation establish a framework, the practical implementation and the collaborative spirit between HMRC and taxpayers will be key to its success.

Certain features of the regime, such as the five-year period of validity, the exclusion of a broad range of topics or areas of uncertainty, and onerous requirements to update clearances for project changes, may impact its attractiveness. It has a narrower focus than similar mechanisms offered in other territories which could impact the UK competitiveness. The government intends to review the service after its first year, with a view to reducing the financial threshold and allowing more applicants to benefit. It is hoped that this will include reflection on whether key limitations to the regime can be amended to improve investor confidence in the service.

Please speak with your usual Deloitte contact or any of the contacts below if you would like to discuss.

.jpg)