Freeports and Investment Zones: Where did they end up, and where are we going?

Part 2 - Investment Zones

28/07/2023

Investment Zones

On 26 July, the second specific Investment Zones location was confirmed – in Liverpool, with a focus on life sciences. This follows the announcement on 14 July of the first specific Investment Zones location, the South Yorkshire Advanced Manufacturing Investment Zone.

12 Investment Zones are being planned for the UK, offering tax reliefs and other flexible grants to support digital/technology, life sciences, creative industries, green industries and advanced manufacturing.

Each zone will be centred on a university, and although precise locations are to be confirmed for all sites other than South Yorkshire and Liverpool, the broad areas already announced include the West Midlands, Glasgow, Manchester and the Tees Valley.

Tax incentives will apply within “Tax Sites” (up to three per Investment Zone), which aim to develop brownfield sites. The tax reliefs will broadly align with those in Freeports, however the zones will not enjoy the extra Freeport VAT and Customs benefits. Now that 100% expensing has been introduced for capital expenditure, the tax reliefs are more marginal and will be of most benefit to those employing larger numbers of people because of the higher threshold for Employer’s National Insurance (saving up to £2,200 per employee per year for three years) and/or those that need substantial premises to operate. Businesses will likely gain more benefit from being part of an innovation ecosystem, supported by the availability of flexible grants.

The government intends to have the first proposals agreed this summer, with funding commencing in 2024/25. To read our analysis of how the new Investment Zones will work, see the article below.

Investment Zones: considerations for businesses

Part 1 of our Deloitte Insights series on the UK Freeport and Investment Zone regimes, located here, looked at the qualifying criteria and tax and customs incentives available in Freeports, and how Freeports reliefs could impact businesses’ investment decisions. Part 2 focusses on Investment Zones, their potential interaction with Freeports and the wider UK tax incentives and grants/subsidies environment, as well as how they link to the government’s ‘levelling up’ agenda and the UK Science and Technology Framework.

Part 2 - Investment Zones

In his 2023 Spring Budget speech, the Chancellor announced that the government “will deliver 12 new Investment Zones, 12 potential Canary Wharfs”. The proposal - eight Investment Zones in England and four across Scotland, Wales and Northern Ireland - aims to catalyse “high-potential knowledge-intensive growth clusters”. The Investment Zones will benefit from what the government describes as “generous tax incentives” (“a single five-year tax package for businesses”), providing useful certainty for businesses into the medium term. This applies alongside flexible “grant funding to address local productivity barriers”. Government support will amount to £80 million per Investment Zone.

What’s in it for business?

Compared to the more generous proposals initially announced in the “Growth Plan 2022” mini budget, the tax reliefs offered in Investment Zones at most align with those in Freeports, and they don’t have the Freeport VAT/Customs benefits (see “tax incentives” section below for more detail).

So if marginal tax reliefs are not the main appeal, the real benefit for innovation-intensive businesses will be from a) the potential for clustering of R&D activities, bringing access to labour markets or economies of scale, and b) the grant funding – one of the most robust Government interventions a business can add to their business case.

Where will they be located?

Investment Zones are geographically-defined areas containing designated tax sites, targeted at “high-potential” areas with the aim of boosting innovation, productivity and growth.

The zones will need to focus on one or more of five priority sectors: digital and technology; life sciences; creative industries; green industries; and advanced manufacturing.

At the 2023 Spring Budget, Government announced it would invite local partners within the following Combined Authorities to begin discussions on hosting an Investment Zone:

· East Midlands

· Greater Manchester

· Liverpool City Region

· North East

· South Yorkshire

· Tees Valley

· West Midlands

· West Yorkshire

The government also said that it would engage with the devolved administrations in Scotland, Wales and Northern Ireland to establish at least one new Investment Zone in each location, with Glasgow City Region and the North East of Scotland (Aberdeen) subsequently selected to host Scotland’s Investment Zones.

Specific locations within these areas are yet to be confirmed, however Jeremy Hunt has announced they “will all be centred on a university, because we want them to become clusters for high-growth industries”. On 14 July, the first specific site was announced – the South Yorkshire Advanced Manufacturing Investment Zone. This site will be focussed on advanced manufacturing through partnerships with the University of Sheffield and Sheffield Hallam University and several private sector industry partners, centring on Sheffield, Rotherham, Doncaster and Barnsley.

While the English Freeport sites are fairly evenly distributed, the proposed Investment Zones for England are all based in the Midlands and the North, perhaps indicating a greater focus on ‘levelling up’ objectives.

.png)

Policy Model

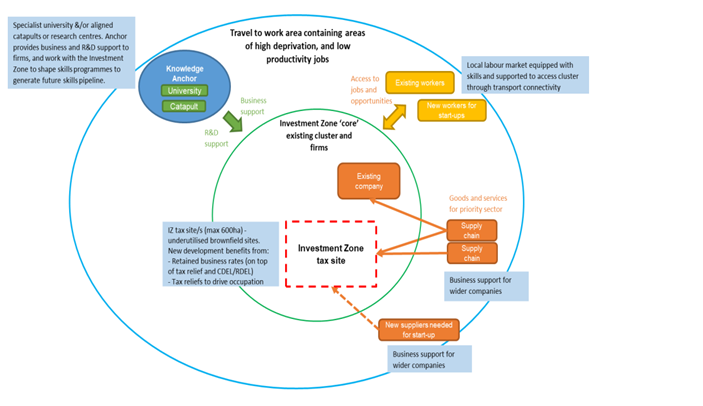

The Investment Zones policy consists of four pillars which aim to leverage existing strengths in the further education and research sectors:

1. Spatial Focus – sites are expected to have a clear core economic geography that drives innovation in the target sector(s), accompanied by planning interventions such as Local Development Orders.

2. University or Research Institute – universities and local research institutions will support innovative R&D activity, establishing partnerships and networks to raise the productive potential of the area. This links into the ‘UK Science and Technology Framework’, which stresses the importance of the UK’s universities for innovation in the UK.

3. Wider Cluster Ecosystem – upskilling the local labour market and creating opportunities for new businesses and start-ups and for existing businesses to expand.

4. Strong Local Leadership – local leaders will be empowered to build “coalitions” with business leaders and research institutions, supporting skills, development and infrastructure.

Investment Zone design

Each Investment Zone can develop one proposal containing up to three tax sites in “underdeveloped” land, such as empty or brownfield land, or under-utilised land with some construction and vacant premises.

Outside the specific tax sites there will be a wider Investment Zone ‘core’, and an even broader Investment Zone ecosystem.

Investment Zone Policy Prospectus – HM Treasury / Department for Levelling Up, Housing & Communities, 15 March 2023 (Investment_Zone_Policy_Prospectus.pdf (publishing.service.gov.uk))

The government expects that a typical Investment Zone will benefit from £45 million of tax incentives over five years, as well as £35 million of flexible spend to support research and innovation (eg through improving local infrastructure or grants to help commercialise and bring products to market) and skills (eg sector-specific skills programmes such as bootcamps or apprenticeships). Business rates growth above an agreed baseline in designated sites can also be retained locally for 25 years to support local economic growth.

The total government investment of £960 million across the 12 Investment Zones, spread over five years, is somewhat overshadowed by other 2023 Spring Budget investment and innovation measures such as the enhanced capital allowances relief (forecast cost £27.8 billion over 2022-2028) and the additional tax relief for R&D-intensive SMEs (forecast cost £1.8 billion over 2023-2028).

Tax incentives

The incentives available align with those already available in Freeports:

1. Employer National Insurance Contributions (“NICs”) threshold raised from £9,100 (2023/24) to £25,000 in respect of new employees, saving up to £2,200 per eligible employee per year;

2. Full Stamp Duty Land Tax (“SDLT”) relief for land and buildings bought for commercial use or development for commercial purposes;

3. Full Business Rates relief for newly occupied business premises, and certain existing businesses where they expand in Investment Zone tax sites;

4. First year capital allowances (“FYAs”): a 100% first-year allowance for expenditure on plant and machinery; and

5. Enhanced Structures and Buildings Allowances (“SBAs”): 10% straight-line deduction p.a. over 10 years, vs the normal 3% straight-line deduction p.a. over 33.3 years.

For details of the qualifying criteria and examples of how these reliefs operate, please see our previous Insights piece.

Certain elements of these tax reliefs have been impacted, and largely superseded, since their introduction for Freeports. In particular, at the 2023 Spring Budget it was announced that for three years from 1 April 2023, a 100% first-year capital allowance for qualifying main pool plant and machinery expenditure (‘full expensing’), and a 50% first-year allowance for qualifying special rate pool expenditure, now applies across the UK. This accompanies the permanent setting of the Annual Investment Allowance - another 100% first-year relief for certain capital expenditure - at £1 million per group per annum, which the government estimates is sufficient to cover the expenditure of 99% of UK businesses. The capital allowances relief in Investment Zone (and Freeport) tax sites is only greater than the widely-available relief for certain categories of expenditure, reducing the comparative appeal of Investment Zones.

So businesses may derive the most additional value from the NICs relief, although a) the threshold of £25,000 is likely to be significantly lower than many salaries in research clusters and b) the qualifying requirement for employees to spend 60% of their time in the Investment Zone tax site could be difficult to satisfy, given that Investment Zone workers may be used to more flexible working.

As a result, whilst additional tax benefits are available, many businesses considering establishing in Investment Zones may see more value from being part of an innovation ecosystem, supported by the availability of flexible grants.

Timetable

The government intends to have the first proposals agreed this summer, with funding commencing in 2024-25.

The House of Commons Business and Trade Committee has opened an inquiry into the performance of Investment Zones and Freeports in England, to consider what progress has been made and how England can make the most of the regimes.

What should I be doing now?

Businesses should monitor the implementation of Freeports and the development of Investment Zones, including the proposed sites, to evaluate them as an option when planning future investments. Horizon scanning of other grants and incentive regimes will help to identify wider potential government support for research and innovation.

For help in understanding more about the Freeport and Investment Zone regimes, or in assessing how they could be of benefit to your business, please contact our specialists using the details below.

For further reading, a separate Deloitte report located here explores how the lessons of major programme delivery can be applied to UK Freeports to ensure they deliver on the government’s ‘levelling up’ and growth objectives.

You can also track the ever-evolving UK tax policy landscape by accessing our UK Tax Policy Map.

-(002).jpg-dpn-photo.jpg)