Spring Statement 2022 - Part Two: Signposting future changes

13/04/2022

On Wednesday 23 March, the Chancellor delivered his Spring Statement and we set out our analysis of the key measures in ‘Part one’ here. The measures were characterised by helping consumers with the cost of living and taking steps towards reducing energy consumption and reliance on fossil fuels. However, decisions affecting businesses were largely deferred until the Autumn Budget, with the Chancellor identifying key areas the government will be consulting on over the next few months.

In line with his Mais lecture delivered a few weeks ago, the Chancellor took the opportunity of the Spring Statement to reiterate his intention to focus on incentivising training, innovation and investment. The ‘Spring Statement Tax Plan’ released on the day gives us some indication of what this might entail, with focus on three areas in particular:

Capital

With the super-deduction set to end on 31 March 2023, the government is looking to build on the momentum it was aiming for, given that so far the measure appears to be achieving less than expected. The Office for Budget Responsibility (OBR) halved the anticipated peak of business investment driven by the super-deduction to 5 per cent in 2022-23 from 10 per cent previously. The reality is that investment cycles are just not that easy to accelerate – but they are easy to defer, and the interaction with the increase in the headline corporation tax rate to 25% from 1 April 2023 is undoubtedly another factor at play. The downward revision by the OBR of the impact of the super-deduction may now encourage the government to consider implementing an alternative, improved mechanism to achieve its goal of driving business investment, rather than merely extending the super-deduction.

Either way, businesses are particularly keen to see longer-term measures put in place to provide certainly and stability, which the Treasury does seem keen to explore.

It will be interesting to see if the replacement of the super-deduction (or indeed its continuation in an altered form) provides enhanced relief specifically for ‘green’ capital investment to align with the government’s net zero goals – advancing two political aims at once. For example, this could take the form of maintaining the super-deduction beyond March 2023 solely for specific green expenditure, or reinstating Enhanced Capital Allowances for energy-saving equipment. However, so far, the five potential options under consideration as set out the Spring Statement do not address ‘green’ capital investment, with only a passing reference to “new reliefs targeted at specific investments” being a possible consideration.

Ideas

The 2021 Autumn Budget and November 2021 ‘Tax Reliefs Report’ confirmed the broadening of the scope of Research and Development (R&D) tax relief from April 2023 to include data and cloud computing costs. Further extensions were announced in the Spring Statement to include R&D underpinned by pure mathematics and data storage cloud costs. It was also confirmed that R&D undertaken by businesses based in the UK will be able to continue to qualify for tax reliefs where there is a material or regulatory requirement for this work to actually be carried out overseas.

However, one could describe this as tinkering and it looks like the Chancellor is looking to go much further than this, recognising that UK businesses’ R&D expenditure as a percentage of GDP is lagging some way behind the OECD average. Expenditure will need to nearly double in the next 5 years to achieve the government’s previously stated goal of R&D reaching 2.4% of GDP by 2027. The government had already announced that consideration will be given in the Autumn to increasing the generosity of the Research and Development Expenditure Credit (RDEC) regime to boost R&D investment in the UK and make the RDEC more internationally competitive – but what might they do? OECD statistics show that R&D tax incentives in the Netherlands have a larger impact on the effective average tax rate of an investment than the reliefs available in the UK – for 2021, the UK had an implied tax subsidy rate for R&D expenditure of 12% for large companies and 27% for SMEs, in comparison to 15% and 39% respectively in the Netherlands.

The Netherlands has an attractive wage tax credit scheme for R&D expenditure and an ‘Innovation Box’ that offers a reduced tax rate on profits derived from innovation; these are similar to the UK’s current RDEC and Patent Box regimes in terms of design, but offer a more generous level of credit or deduction, and could therefore provide a model for the enhancement of relief in the UK. Monitoring the interaction with the Pillar Two global minimum tax regime will be important in ensuring the effectiveness of any reforms. Depending on the final rules and the business’ tax position, an innovation tax relief that results in top-up tax being paid by businesses in scope of Pillar Two would obviously be less effective in the long-term than a regime that does not reduce the business’ effective tax rate for Pillar Two purposes.

We could see some really effective links made with other government objectives here, particularly achieving net zero and levelling up. However, the government’s new Energy Strategy had hardly any references to funding, reliefs or investment by the private sector. There has been little action from the Treasury on levelling up so far – it received only one mention in the Spring Statement and is yet to get any additional funding. This could be the opportunity to use tax and incentive levers to make a step change in achieving policy aims.

People

The government will also explore how to encourage businesses to offer more high-quality employee training. This will focus in particular on whether the operation of the Apprenticeship Levy is incentivising businesses to invest in the right kinds of training. The Apprenticeship Levy came into effect on 6 April 2017, and requires employers to pay 0.5% of their annual pay bill that is liable to employer’s Class 1 secondary National Insurance Contributions (NICs), subject to an annual group allowance of £15,000. Levy-paying employers can access hypothecated funds to spend on apprenticeship training, but there are concerns from businesses regarding the way that these funds can be spent.

With receipts of £2.9 billion in the 2020-21 tax year, this is a significant fund that if used effectively by businesses could have a real impact on high-quality employee training and boost long-term productivity. However, there is some evidence that the current restrictions on the use of funds raised via the Apprenticeship Levy lead to an inefficient allocation of resources. For example, a recent survey from the Chartered Institute of Personnel and Development found that only 17% of senior HR managers surveyed were in support of maintaining the Apprenticeship Levy as it is, with over half in favour of reform in respect of the use of the associated funds.

Concluding thoughts

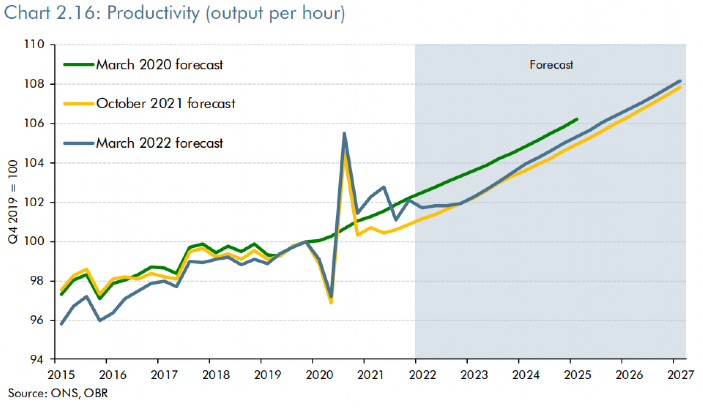

The Spring Statement Tax Plan sends a clear signal that the Chancellor is focussing on growth driven by productivity. However, while the OBR is forecasting a 6% increase in productivity (output per hour) between 2022 and 2027, this follows a structural scarring effect from COVID-19 that will still leave the UK’s productivity in the medium term noticeably lower than forecast pre-pandemic. There is a real potential to increase growth if tax measures in relation to capital, ideas and people are designed and implemented effectively, but the impact of COVID-19 will continue to be felt and significant productivity growth will be needed to catch-up with the pre-pandemic trend:

Source: OBR Economic and Fiscal Outlook, March 2022

The backdrop is also important here: the pace of change in the tax environment aside from these new proposals shows no sign of letting up, with further major changes on the horizon even while numerous existing formal consultations are either awaited, open or awaiting a response – those that closed in February alone included reforms to the business rates system, umbrella companies in the labour market, landfill tax, and stamp duty rules.

While some businesses may be disappointed in having to wait until the autumn for more certainty, this will allow time to engage with the government on proposals for what could be a very significant change to the UK’s tax relief environment for expenditure on capital investment, innovation and training. HMRC and the Treasury confirmed that this consultation process is going to be through business groups and roundtables rather than formal written consultation so we would encourage businesses to engage with government accordingly to make their voices heard.

For further information on the measures announced, visit our dedicated Spring Statement website.

-(002).jpg-dpn-photo.jpg)